AI Summary

Do you want to compare Stripe vs. Square to determine the best payment solution for your business?

Stripe and Square are both trustworthy and reliable payment gateways. In this post, we’ll compare and contrast the most important points to help you easily determine which is right for you based on your business needs.

Stripe vs. Square: Key Points of Comparison

In each section below, we’ll compare Stripe and Square to see how they stack up in each category.

| Feature | Stripe | Square |

|---|---|---|

| Payment Processing | Online payments, subscription billing, invoices | Online and in-person payments, POS systems |

| Hardware Options | Stripe Reader, BBPOS WisePOS | Square Reader, Terminal, Register |

| Platform Focus | eCommerce, marketplaces, subscription services | Retail, food and beverage, service industries, eCommerce |

| Global Availability | Accepts payments in over 135 currencies | Available in limited countries with local support |

- Overview of Stripe vs Square Fees

- Hardware & Card Readers

- Which Payment Processor Has Better Integration Options: Stripe or Square?

- Integration With WPForms

- Fraud Protection

- Chargebacks and Refunds

- Customer Support

- Currencies and Global Availability

- Payouts

- Online Invoicing

- Stripe vs Square for Small Businesses: Which Is Best For You?

Overview of Stripe vs Square Fees

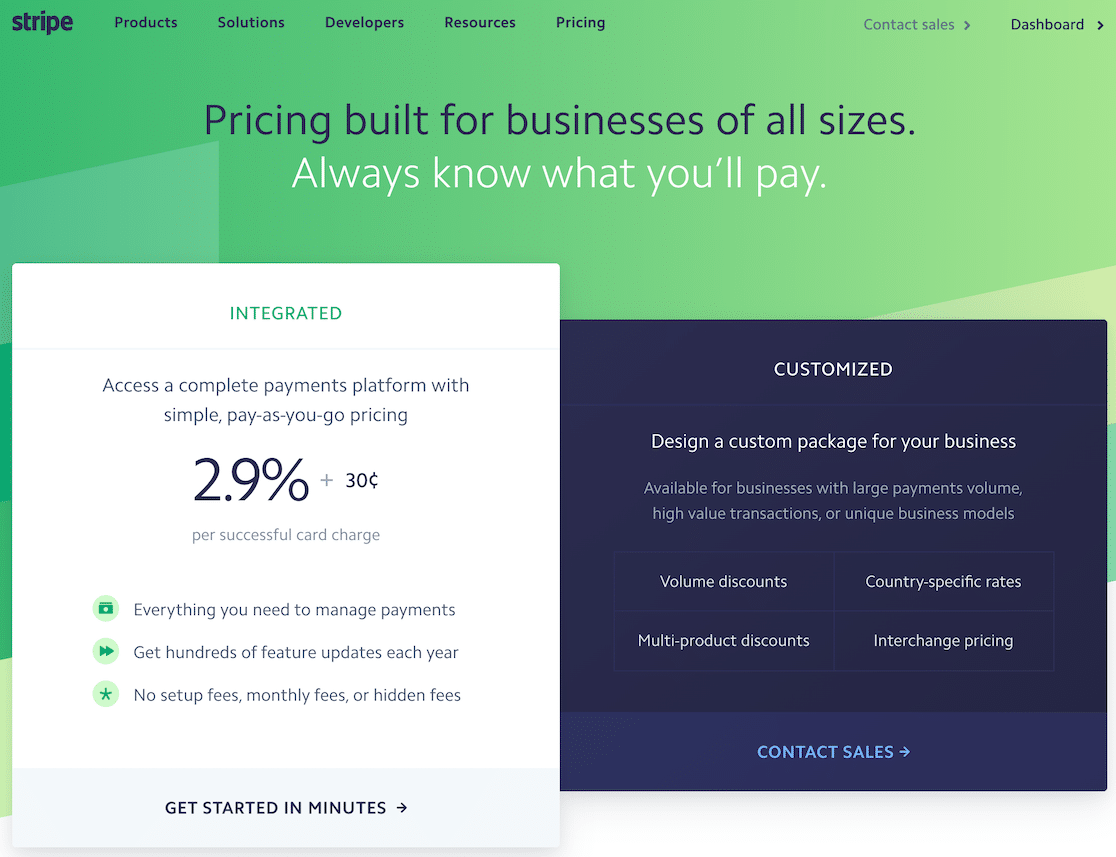

Stripe

Stripe offers pay-as-you-go pricing, meaning you’re not locked into a plan or pricing. You won’t need to worry about setup fees, hidden fees, or monthly fees.

- Transaction Fees: 2.9% + 30¢ per successful card charge.

- Customized Pricing: Available for high-volume businesses.

- No Setup or Monthly Fees: Pay-as-you-go model.

- Additional Services: Fees for advanced features like Stripe Radar for fraud prevention.

View a current list of Stripe’s pricing and fees.

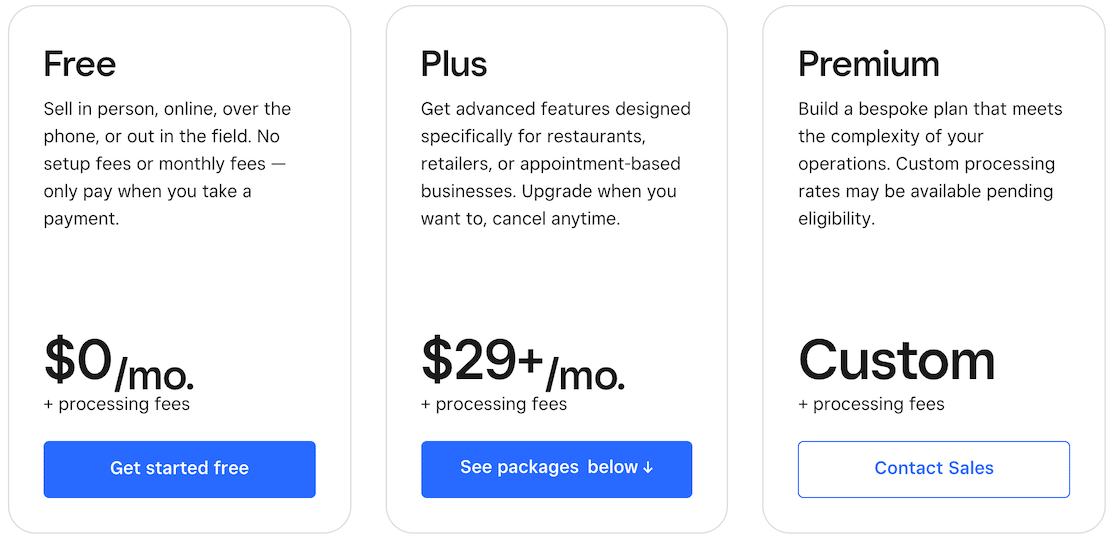

Square

Square’s costs depend on your plan. Like Stripe, there’s a free plan. For $29 a month, you can sign up for the Plus plan, which offers advanced features for restaurants, retailers, and appointment-based businesses.

Square also has a Premium plan that allows you to create your own custom plan.

In all cases, there will be processing fees. Here are a few examples of what you can expect to pay for those:

- In-Person Transactions: 2.6% + 10¢ p

- Online Transactions: 2.9% + 30¢

- Manual Entry: 3.5% + 15¢

- Hardware Costs: Varies based on the device (e.g., Square Reader starts at $49).

- Software Subscriptions: Optional monthly fees for advanced POS software.

View a current list of Square’s pricing and fees.

Hardware & Card Readers

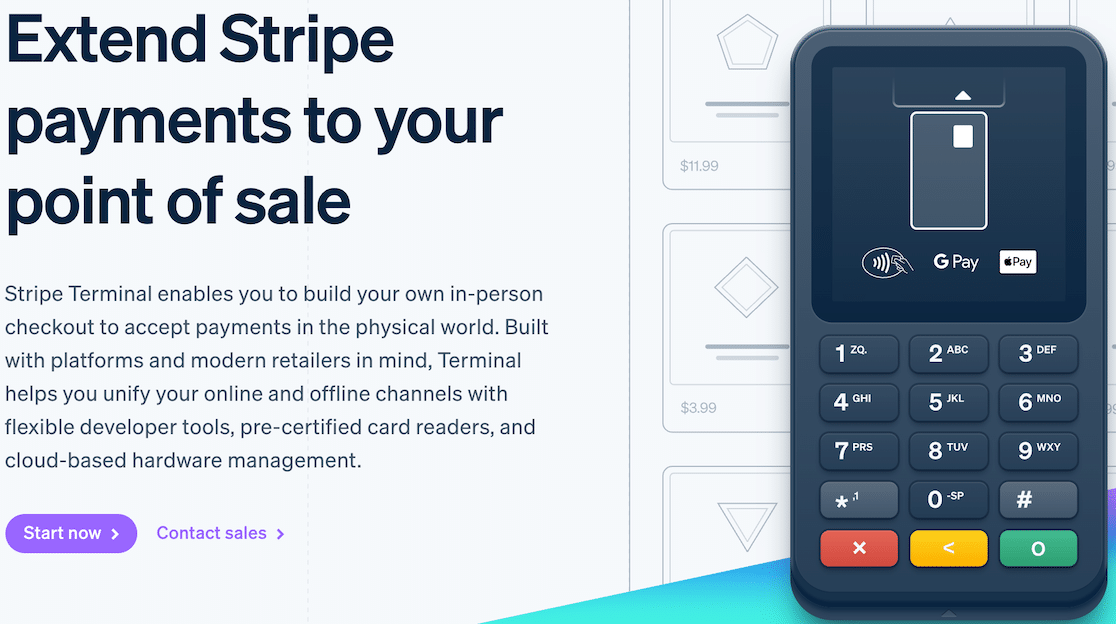

Stripe

In-person payments aren’t what Stripe is mainly known for. But Stripe has expanded its range of card readers to offer pretty convenient in-store transactions and mobile tap payments. I also like that you can accept payments directly through you iPhone or Android phone without needing specialized hardware.

These devices range in price from $59 for a simple Stripe reader to $349 for a more complete POS system that can also be used as a handheld device.

To reduce costs, you can use your Apple or Android phone to accept contactless payments via the Stripe app.

In addition to standard fees, there is a 10¢ fee per authorization, as well as a 5¢ fee per transaction for point-to-point encryption.

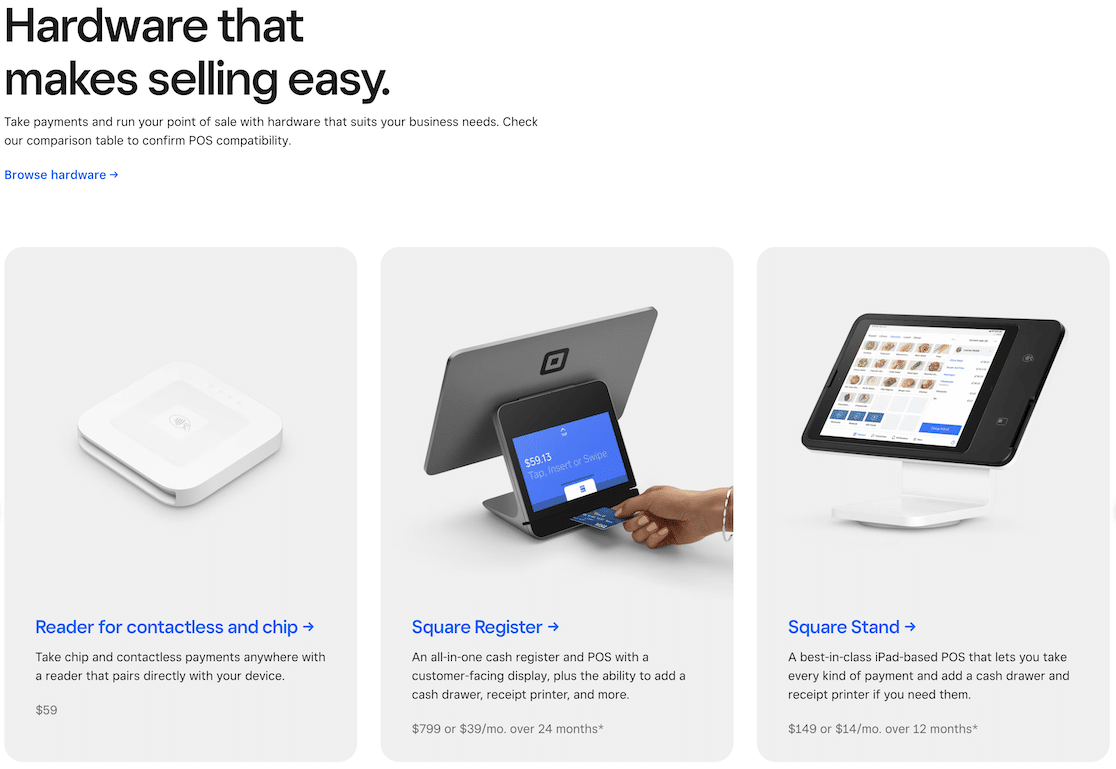

Square

Square is even better with card reader hardware, which isn’t a surprise considering this is Square’s primary focus. When merchants first sign up, Square sends you a mobile card reader. This is completely free of cost, super portable, and very easy to set up. It connects with your Android of iPhone phone jack, allowing you to turn your handheld into a tiny POS sytem.

Square also has accessories you can connect, such as printers, cash drawers, scanners, iPad stands, and more.

You have even more robust options with hardware equipment like Square Register, Square Kiosk, and more which with comprehensive POS software for your business.

Which Payment Processor Has Better Integration Options: Stripe or Square?

Stripe

Stripe has a fantastic range of third-party integrations. I was impressed to see that it supports easy integrations with tools and platforms for billing, fraud detection, financial services, marketing, and even climate impact apps.

Besides, Stripe readily integrates with CMS like WordPress and eCommerce platforms like Big Commerce, Shopfiy, Magento etc.

Square

Square is pretty good with integrations. It contrasts with Stripe by being more focused on certain industries, such as booking apps and delivery service apps.

But like Stripe, it supports popular eCommerce platforms and CMS, including form builders like WPForms. So you’ll have no trouble integrating Square with your website.

Integration With WPForms

The great news for WPForms users is that you can use either of these payment processors to collect payments or donations online through your WordPress forms!

Stripe

Stripe payments are available to all WPForms users, including those using WPForms Lite.

That means all WPForms users have access to some powerful features when it comes to accepting payments, including Stripe Webhooks.

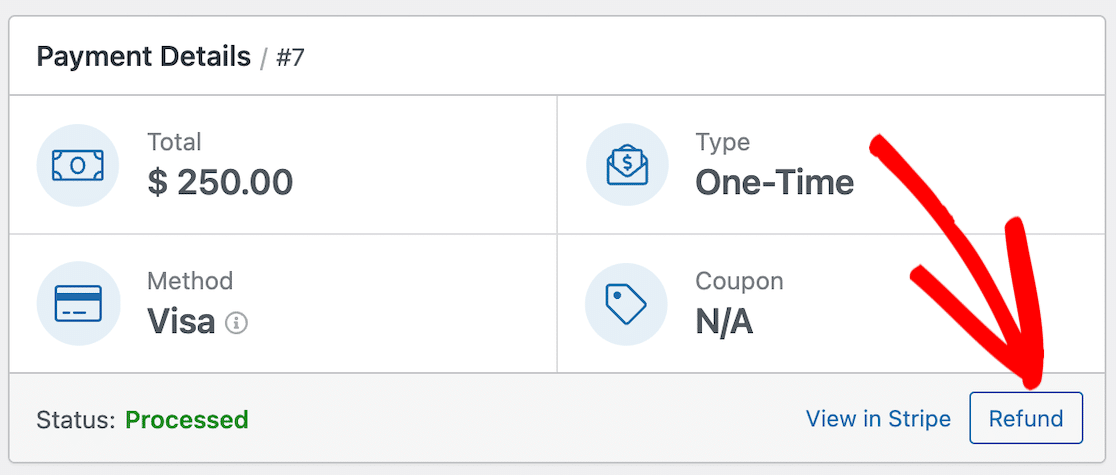

When webhooks are enabled, they act like a messenger between your Stripe account and your WPForms dashboard. This means that you don’t need to log in to 2 different platforms to conduct business. You can manage subscriptions, cancelations, and refunds, right from your Stripe dashboard.

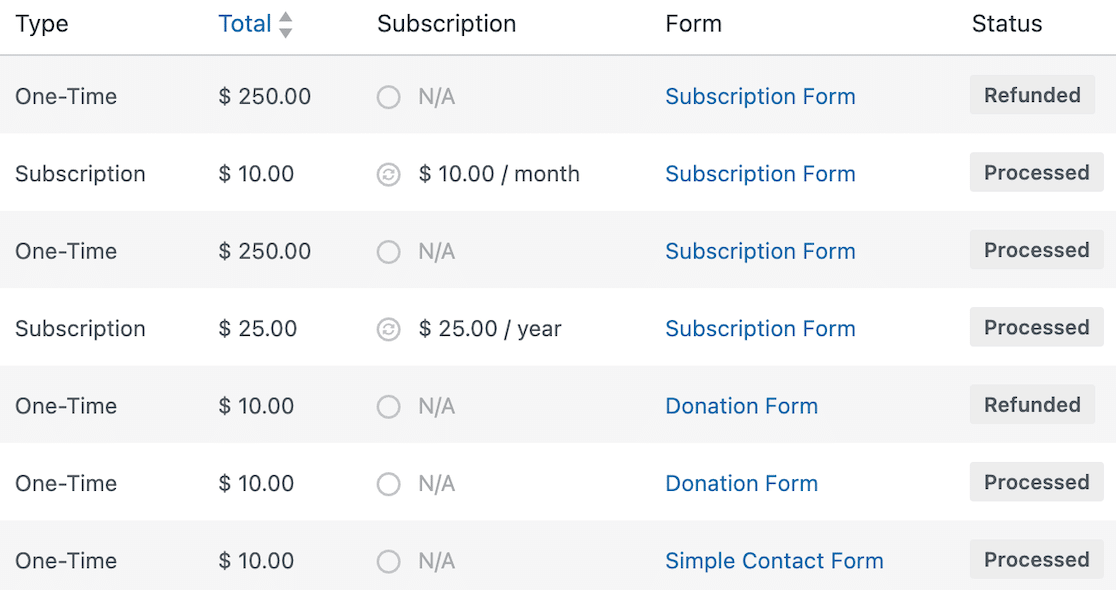

You can even see the entire log of payments, refunds, subscriptions, and cancelations, and their status all in one place. It’s super easy to manage your Stripe payments right in WPForms.

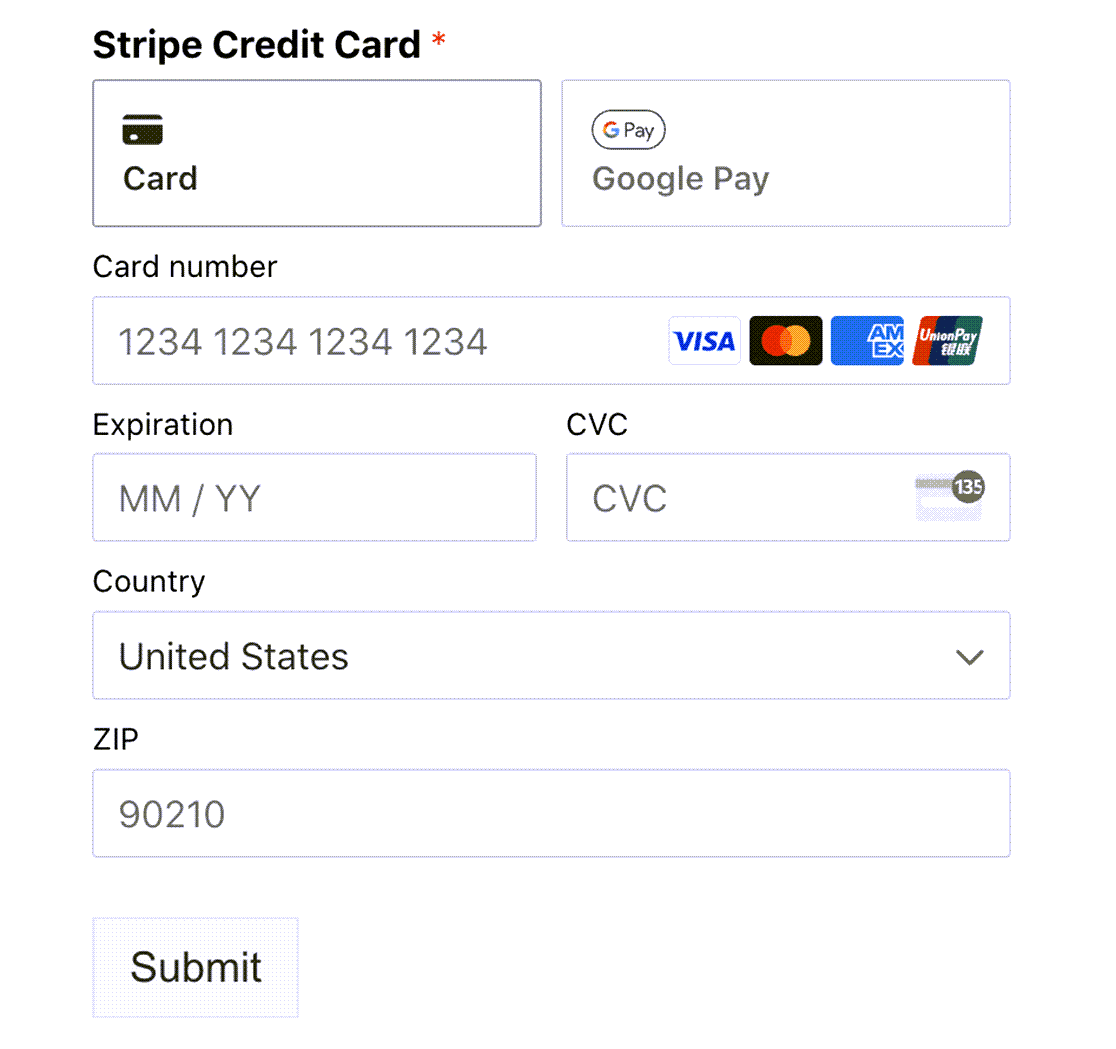

When you connect to Stripe using WPForms, your customers can also pay via Apple Pay or Google Pay.

They will only see these payment methods if they’re logged in to their accounts on a device that supports Google Pay or Apple Pay.

When that mode of payment is available, users will see the option, like in the below example with Google Pay.

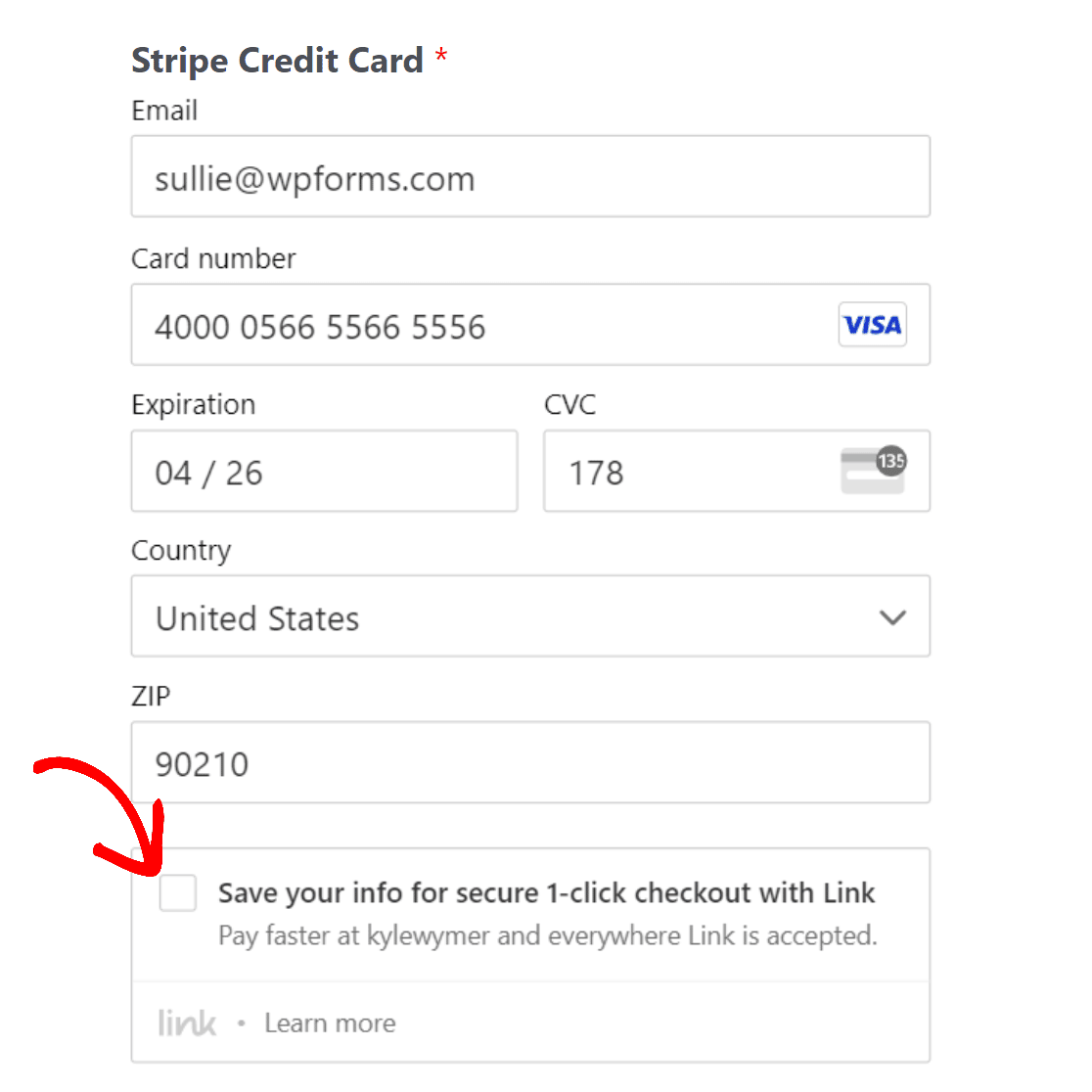

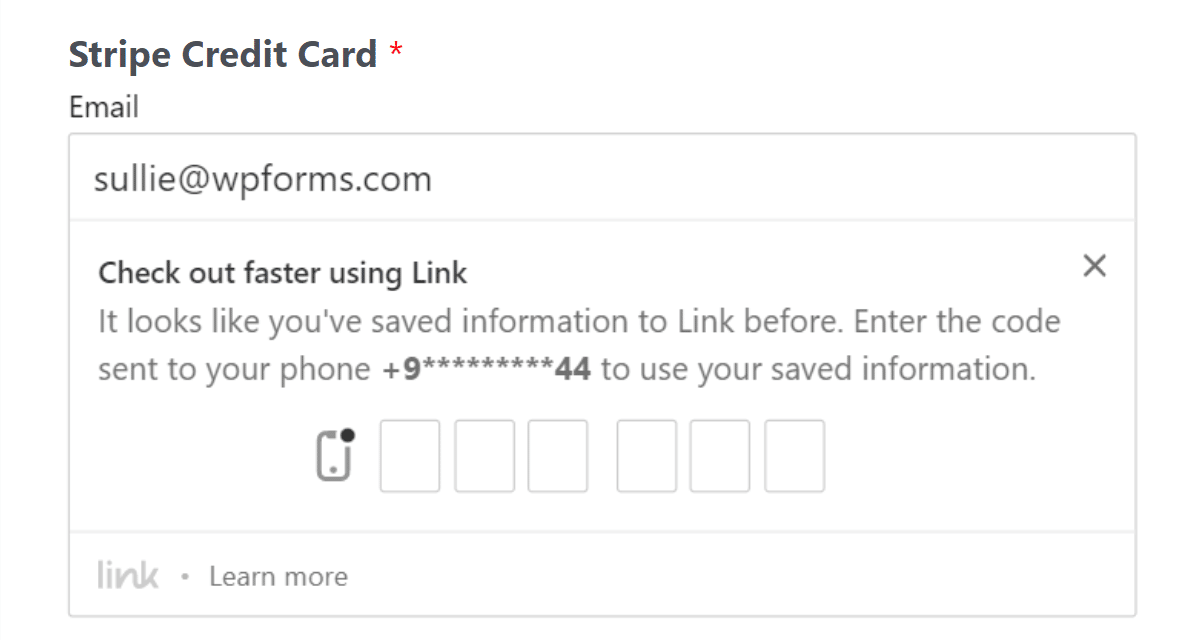

Another useful feature with Stripe is the ability for buyers to check out faster using Link.

After the initial setup, users will only need their email addresses to make payments. Link will store their payment information for secure 1-click checkout.

There is a 3% fee in addition to the normal Stripe fees per transaction.

Need to cut costs? If you upgrade to WPForms Pro, the 3% fee is waived and only normal Stripe transaction fees apply. As an added perk, you’ll also be able to use conditional logic for Stripe payments when you install the Stripe Pro addon, which comes with your WPForms Pro account.

By upgrading, you’ll save money in the long run and get access to tons of other great features and added functionality that Pro users enjoy.

Square

You can easily integrate your Square account with WPForms using the Square Pro addon. When you install the addon and connect your Square account to WPForms, you can quickly and easily collect Square payments, donations, and more.

And, WPForms users rejoice! Square is also available with all WPForms license levels, including Lite.

Fraud Protection

Stripe and Square both use machine learning to help protect against fraud. Both are PCI-compliant, as well.

Stripe

Stripe’s fraud protection is known as Radar. There’s a 5¢ fee per screened transaction, but it’s waived for accounts with the standard 2.9% + 30¢ fee pricing.

Radar is built into Stripe, so there’s no need to download or enable anything. It’s quite a dept at verifying identities in over 30 countries, which is especially useful if you accept international transactions,

On top of that, Stripe integrates with third-party fraud detection tools as well. For instance, you can integrate Stripe with address verification tools to identify fake addresses.

Square

Square also uses machine learning to detect fraud trends. Their team reaches out to merchants if it detects anything unusual. Square will also manage disputes for you.

Chargebacks and Refunds

Chargebacks and refunds happen sometimes, so you want a payment processor that will help you work through the process in the most seamless way possible. Stripe and Square both offer support.

Stripe

Stripe will help you with chargebacks, but there are a few catches. First, you must be processing payments on Stripe for a minimum of 6 months to be eligible for Stripe Chargeback Protection.

Stripe will also charge a $15 chargeback fee.

Other fees may apply depending on your Stripe plan and fee schedule. While refunds can be issued in part or full, the original payment processing fee isn’t returned.

That said, if a fraudulent dispute arises, Stripe will cover the amount and waive any dispute fees.

I find Stripe’s support for chargeback and dispute management apps quite helpful. For instance, you can integrate with Chargeblast to set up pre-chargeback notifications. This is great for processing refunds before a chargeback occurs, helping you reduce disputes.

Square

In contrast to Stripe, Square does not charge a dispute fee when chargebacks occur. Only the normal transaction fees apply.

The process is pretty simple. If a customer disputes a charge, Square will notify you, the merchant. You can determine how you’d like to proceed. You can either accept the dispute charge, or you can challenge it.

A challenge requires you to send documentation. It’s important to note that payment processors aren’t the ones who make the final determinations in disputes. If a bank or credit card company rules in your favor, the original transaction will stand. If not, you’ll be responsible for paying the processing fee.

Customer Support

Reliable customer support is a must-have. Both Stripe and Square offer comparable levels of support for you.

Stripe

A self-serve resource page on Stripe’s site allows you to answer your question or resolve your issue quickly on your own. When you enter a search term, you’ll get relevant help articles that can walk you through your issue.

If you can’t find what you’re looking for there, you can contact support by phone, email, or chat. This support is available to all Stripe customers 24/7.

Additionally, Stripe offers Growth, Premium, and Enterprise support plans. When you purchase one of these plans, you get additional guidance. Depending on your plan, this could include prioritized ticket routing, critical issue escalation, and real-time incident monitoring.

Square

Like Stripe, Square allows you to access a repository of documents and content that will help answer your questions. If that doesn’t work, you also have other options.

There’s a seller community that you can join to ask questions and learn from others.

You can also reach out to the support team via phone or live chat, Monday through Friday, 6 a.m. to 6 p.m. PST.

Currencies and Global Availability

When it comes to availability, Stripe is available in more countries than Square. Let’s take a look.

Stripe

As of this writing, Stripe is available in 46 countries worldwide with support for up to 135 currencies.

Note that it must be available in your country before you can use it. Once it’s available in your country, you can sell internationally to any other country worldwide, regardless of whether Stripe is available there.

Square

Square’s availability is much more limited, with only 8 countries on its list.

- Canada

- Australia

- Japan

- UK

- Republic of Ireland

- France

- Spain

- US

It’s worth noting that Square availability in the US does not extend to US territories such as Puerto Rico, Guam, the US Virgin Islands, American Samoa, and the Northern Mariana Islands.

Square also doesn’t let you make or accept card transactions outside the country where you activated your account. This means that if you set up your account in France and try to accept a transaction from another country, Square won’t process it.

Payouts

For both processors, payouts vary by country.

Stripe

Stripe’s payout speed is generally 2-3 days but can be up to 7 in some countries.

The payout schedule is daily by default, but you can change it to weekly, monthly, or manual schedules. A daily payout just means that you will receive funds every day, but they’ll be based on your payout speed. For example, the funds you receive today might be the funds you earned 2 or 3 days ago.

These payouts are free. If you require instant payouts for same-day funds, there is a 1% fee.

Square

Standard transfers are 1-2 business days after a transaction. When you sign up for Square, you’re enrolled in the standard transfer schedule by default, but you can change to a custom schedule if you like. You can also opt to have funds transferred to a Square card.

If you need to access your money faster, you have a few options.

First, there’s the instant transaction using a debit card from your linked bank account. This is available 24/7, but there is a 1.75% fee per transfer.

Then there are same-day transfers, in which qualifying funds are available at the close of the business day. These also come with a 1.75% fee per transfer.

Finally, if the standard payout schedule doesn’t work for you, there’s always the option of creating a manual schedule, as well.

Online Invoicing

Need to access online invoicing? If this is integral to your business, check out how Stripe and Square compare.

Stripe

Stripe offers online invoicing with no fees or setup costs involved. The only cost you’ll incur is your Stripe payment pricing. On the Stripe Starter plan, you’ll pay 0.4% per invoice. On Stripe Plus, it’s 0.5%.

There are more features with the Plus plan, including automatic collections, auto-reconciliation, and quotes.

Square

Square offers online invoicing as part of its free plan. You can also upgrade to the Plus plan, which is geared more toward growing businesses with more complex needs, for $20 a month.

Square’s invoicing fees are 3.3% + 30¢ for cards. If you use ACH payments for bank transfers, it’s 1% with a minimum of $1 per transaction.

Stripe vs Square for Small Businesses: Which Is Best For You?

Stripe and Square are both powerful payment platforms that will help you take your payment processing to the next level, whether you’re an online store or a brick-and-mortar business. But here’s my recommendation if you can’t pick between the two.

- Use Stripe if you’re focused on online payments: If you’re selling online primarily, Stripe is the more customizable and easily scalable solution. Plus, the wider country and currency coverage is important for online businesses operating in international markets.

- Use Square if you’re focused on in-person transactions: Square is the better choice for in-person transactions due to its wider hardware options with robust POS software features.

Next, Find Out Where Your Data Goes

Ever wonder where your WPForms data goes? Wonder no more! Check out this beginner’s guide to what happens after a user fills out a form.

And if you’re looking for a backup plugin to help protect your WordPress website, we’ve got you covered. Check out the 10 best WordPress backup plugins for a mix of paid and free solutions to keep your site safe and sound.

We’ve also got a Stripe vs. PayPal comparison if you want to compare the two platforms.

Ready to build your form? Get started today with the easiest WordPress form builder plugin. WPForms Pro includes lots of free templates and offers a 14-day money-back guarantee.

If this article helped you out, please follow us on Facebook and Twitter for more free WordPress tutorials and guides.