AI Summary

This isn’t the most comprehensive overview of Stripe vs PayPal by any means. Instead, my goal here is to shine light on a few critical points of comparison that I’ve used every time new entrepreneurs and online business owners that I’ve worked with asked this question.

The tl;dr version of my recommendation between Stripe and PayPal is that, it depends. I know that’s a predictable non-answer, but bear with me here.

While I can’t give you a definite “winner” considering the distinct strengths and weaknesses of both Stripe and PayPal, I can help guide you make the right decision based on what you’re looking for.

Keep reading, and it will become clearer if you should be in the PayPal or Stripe camp. I promise.

Accept Stripe + PayPal on Your Forms Now

- Stripe vs PayPal – Comparison At a Glance

- Is Stripe More Cost-Effective Than PayPal?

- Stripe vs PayPal: Which Gateway Offers Superior Hardware & POS Services?

- Stripe vs PayPal for Nonprofits

- How Do Stripe and PayPal Compare in Terms of Integrations?

- Integration with WPForms

- How Long Do the Payouts Take in Stripe vs PayPal?

- Support, Availability, and Ease of Use: Stripe vs PayPal

- Which Payment Gateway Offers Better Security and Data Migration?

- Does Stripe Hold Funds Like PayPal?

- Stripe vs PayPal – My Verdict

- Is Stripe More Cost-Effective Than PayPal?

Stripe vs PayPal – Comparison At a Glance

Stripe and PayPal stand out as leading payment solutions, as both allow seamless online money collection.

| Service | Stripe | PayPal |

|---|---|---|

| Fee per Transaction* | 2.9% + 30¢** | 2.9% + 49¢* |

| Nonprofit Discount* | 2.2% + 35¢*** | 1.99% + 49¢ |

| Setup Costs or Monthly Fees | No | No |

| Contract Required | No | No |

| Micropayments (<$10) | 5% + 10¢*** | 4.9% + .09¢ |

| Recurring Billing | 0.5%+ | No |

| Chargeback Fee | $15 | $20 |

| Refunds | No Fees Returned | No Fees Returned |

| Customer Support | Email, Help Center, 24/7 Phone & Chat | Email, Help Center, Phone & Chat |

| Ease of Use | Easy | Easy |

| Ease of Setup | Moderate | Easy |

| PCI Compliance | Yes | Yes |

| Countries Available | 45+ | 200+ |

| Access to Funds Times | Instant | Instant |

| Data Portability | Yes | No |

| Online Invoicing | Paid | Free |

| In-Person Card Readers | Paid | Paid |

| Payments Handled 100% on Your Site | Yes | No |

| *US-based only. Fees vary by country.

**In Lite to Plus versions of WPForms, there’s a 3% charge + Stripe fee per transaction. The 3% charge is removed for Pro and above users. ***Includes RADAR fee. See below for more info. | ||

Is Stripe More Cost-Effective Than PayPal?

Both Stripe and PayPal offer plans with no setup costs, basic monthly fees, or contracts.

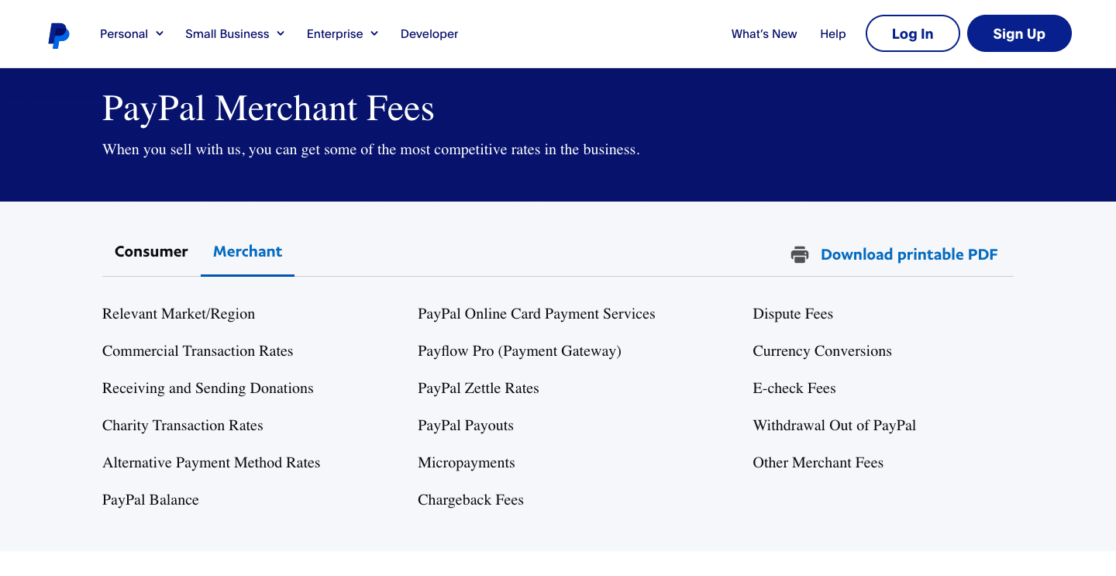

PayPal

PayPal has more complicated pricing which makes it difficult to do an exact one-on-one comparison.

The charges for a payment with PayPal can be as low as 2.29% + fixed fee and as high as 4.99% + a fixed fee. The fixed fee depends on currency used for the transaction. For USD transactions using standard debit/credit cards, the transaction fee is 2.9% + 49¢.

This makes PayPal slightly more expensive than Stripe for standard card payments in USD.

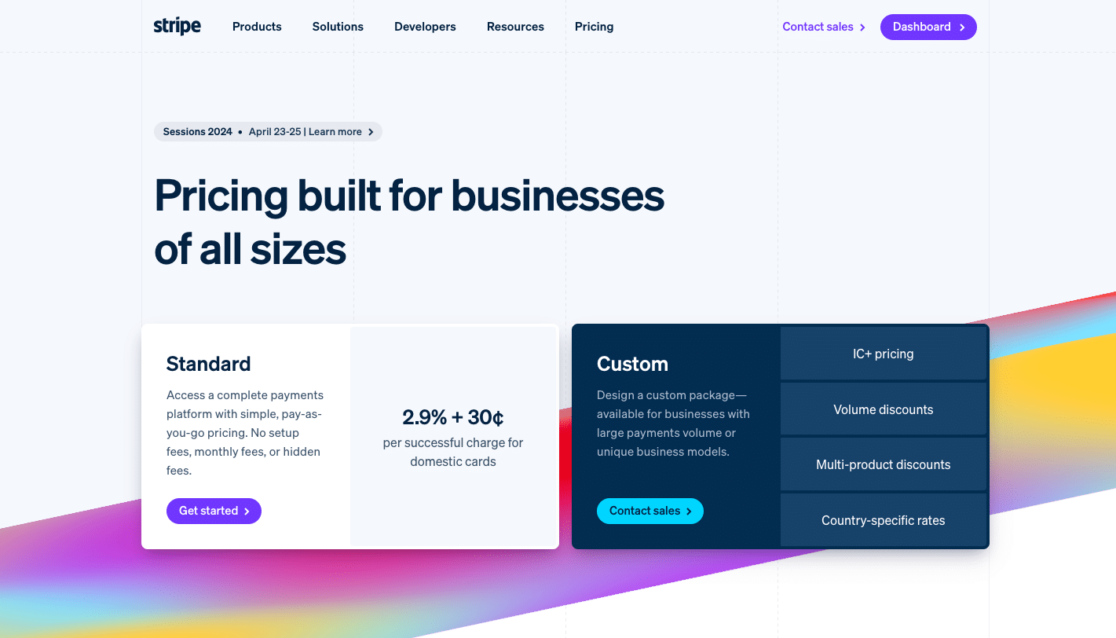

Stripe

Stripe offers pay-as-you-go pricing. For every successful transaciton in USD, Stripe will charge you 2.9% + 30¢. This pricing is the same for all supported debit and credit cards and digital wallets including:

- Mastercard

- VISA

- UnionPay

- American Express

- Discover

- Apple Pay

- Google Pay

Plus, with both Stripe and PayPal, your business is eligible for lower pricing if you hit a certain number in monthly sales.

And with Stripe, you can customize your pricing based on your sales volume and business model. As for PayPal, discounted pricing happens at a much lower sales volume of $3,000 per month.

Both companies offer nonprofit discounts, which makes them a great choice if you’re trying to build nonprofit donation forms for WordPress.

Here’s a further breakdown of additional fees:

- Stripe RADAR Fees: Stripe also charges a RADAR fee of .05¢ for every transaction attempted. The RADAR fee will be charged even if the payment fails. For example, if a user enters the wrong expiry date, you will be charged a RADAR fee for that attempt. If they then try again, you’ll be charged a second RADAR fee, and so on. This fee is waived on Standard accounts. But if you are a nonprofit, you will be charged RADAR fees.

- Micropayments: If you’re processing transactions of less than $10, you’ll be charged a different rate. PayPal’s micropayment rates are 4.9% + .09¢ per transaction. At Stripe, you will be charged the micropayment rate of 5% + .05¢, plus a .05¢ RADAR fee per attempt on top.

- Chargebacks/Refunds: Stripe has a chargeback fee of $15, while PayPal’s chargeback fee is $20. Also, if your customer gets a refund, you won’t get your processing fees back from Stripe or PayPal.

Stripe vs PayPal: Which Gateway Offers Superior Hardware & POS Services?

Stripe

Stripe primarily focuses on online payment processing. It’s what Stripe is popular for.

But Stripe has pretty decent support for in-person transactions as well. I really like that merchants can accept payments directly through their iPhone or Android devices without specialized hardware, utilizing contactless payment features via the Stripe app.

For businesses requiring physical card readers, Stripe offers devices ranging from $59 for a basic reader to $349 for a comprehensive POS system that doubles as a handheld device.

You also incur extra costs for in-person payments. Stripe charges a 10¢ fee per authorization and a 5¢ fee per transaction for point-to-point encryption.

PayPal

PayPal also offers a robust solution for in-person payments through thw PayPal Zettle system. The Zettle card reader is priced at $29 for the first device and $79 for each additional unit.

This reader connects via Bluetooth to a mobile device running the Zettle app. Essentially, it transforms your smartphone or tablet into a full-featured POS system.

For businesses seeking an all-in-one solution, PayPal provides the Zettle Terminal at $190. Zettle terminal integrates the POS app and card reader into a single portable device.

You can use Zettle Terminal with a SIM card, so you don’t even need WiFi access to accept payments with your terminal. Pluss, you don’t need to pair Zettle Terminal with your phone via Bluetooth, so that’s an added convenience in my opinion.

PayPal Zettle supports various payment methods, including credit and debit cards, contactless payments, and PayPal and Venmo QR codes.

Transaction fees for in-person payments are 2.29% plus 9¢ per transaction. Additionally, PayPal offers a range of compatible accessories, such as printers, cash drawers, and barcode scanners, to enhance the POS experience.

Stripe vs PayPal for Nonprofits

Choosing the right payment processor is essential for nonprofits aiming to maximize their donations and efficiency. I find both services very competitive when it comes to their nonprofit offerings but here’s how they differ:

Stripe for Nonprofits

Stripe provides a robust infrastructure for nonprofits, focusing on seamless integration and advanced customization:

- Discounted Processing Fees: Stripe offers reduced processing fees for registered nonprofit organizations, typically around 2.2% + 30¢ per transaction, which can significantly add up in savings for large volumes of small donations.

- Customizable Donation Forms: With Stripe, nonprofits can create custom donation forms easily integrated into their websites, allowing for branded and tailored donor experiences. If you’re a WPForms user, this gets even easier with drag-and-drop forms that you can customize without code.

- Global Reach: Stripe supports multiple currencies and digital wallets like Apple Pay and Google Pay, which is beneficial for nonprofits with international donors.

PayPal for Nonprofits

PayPal is a widely recognized and trusted platform that provides several features catering to nonprofit needs:

- Discounted Processing Fees: PayPal also offers a special rate for nonprofits, generally around 1.99% + 45¢ per transaction, comparable to Stripe’s pricing.

- Ease of Use: PayPal allows donors to contribute using their PayPal accounts or credit/debit cards with no setup hassle. This can be a selling point for donors who are already familiar with PayPal.

- Built-In Donor Tools: Through PayPal’s Giving Fund, nonprofits can benefit from additional exposure, and donors have the option to make recurring donations, enhancing long-term donor relationships.

- Comprehensive Donation Reporting: PayPal provides detailed donation reports, helping nonprofits track donations easily and organize financial data for accounting and tax purposes.

How Do Stripe and PayPal Compare in Terms of Integrations?

Stripe

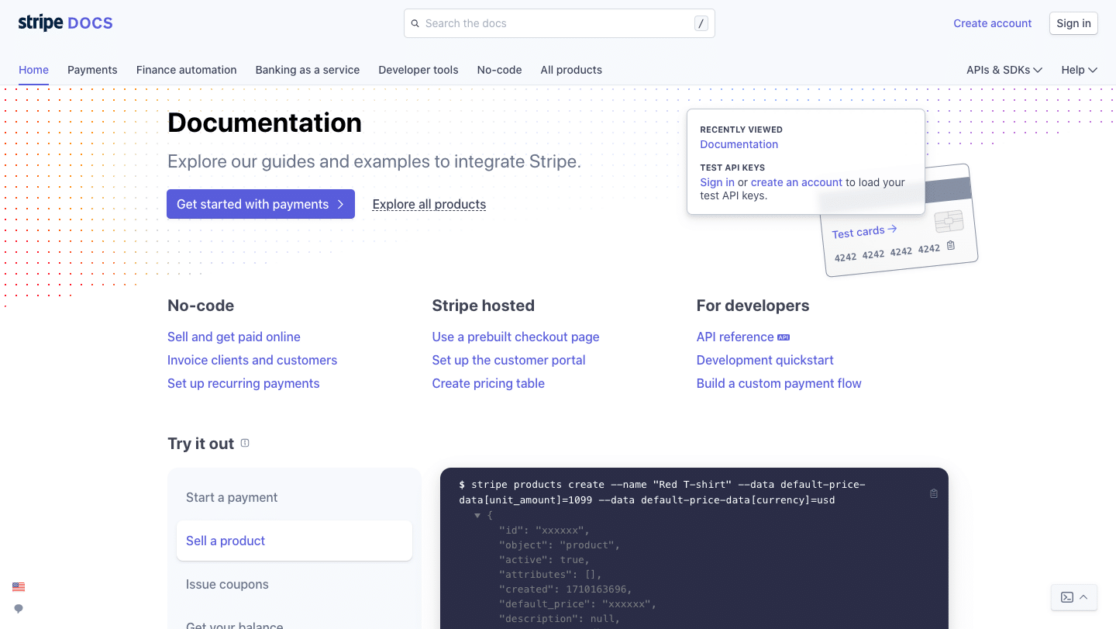

Stripe offers a comprehensive range of third-party integrations. I love the diversity of software that Stripe supports native integrations with apps for billing, fraud detection, financial services, marketing, CMS, and more. It also integrates with some climate impact apps, which is a very welcome initiative.

Some notable integrations include platforms like QuickBooks, Xero, HubSpot, and Zapier, allowing automation and financial management. Stripe is also very developer-friendly with its APIs that enable custom integrations for specific business needs.

PayPal

PayPal’s Partner Solutions Directory includes integrations with e-commerce platforms like Shopify, BigCommerce, and Magento, along with financial tools such as QuickBooks.

PayPal’s integrations are designed for ease of use, making it a good choice for businesses that prefer plug-and-play solutions over extensive customization.

Integration with WPForms

Stripe

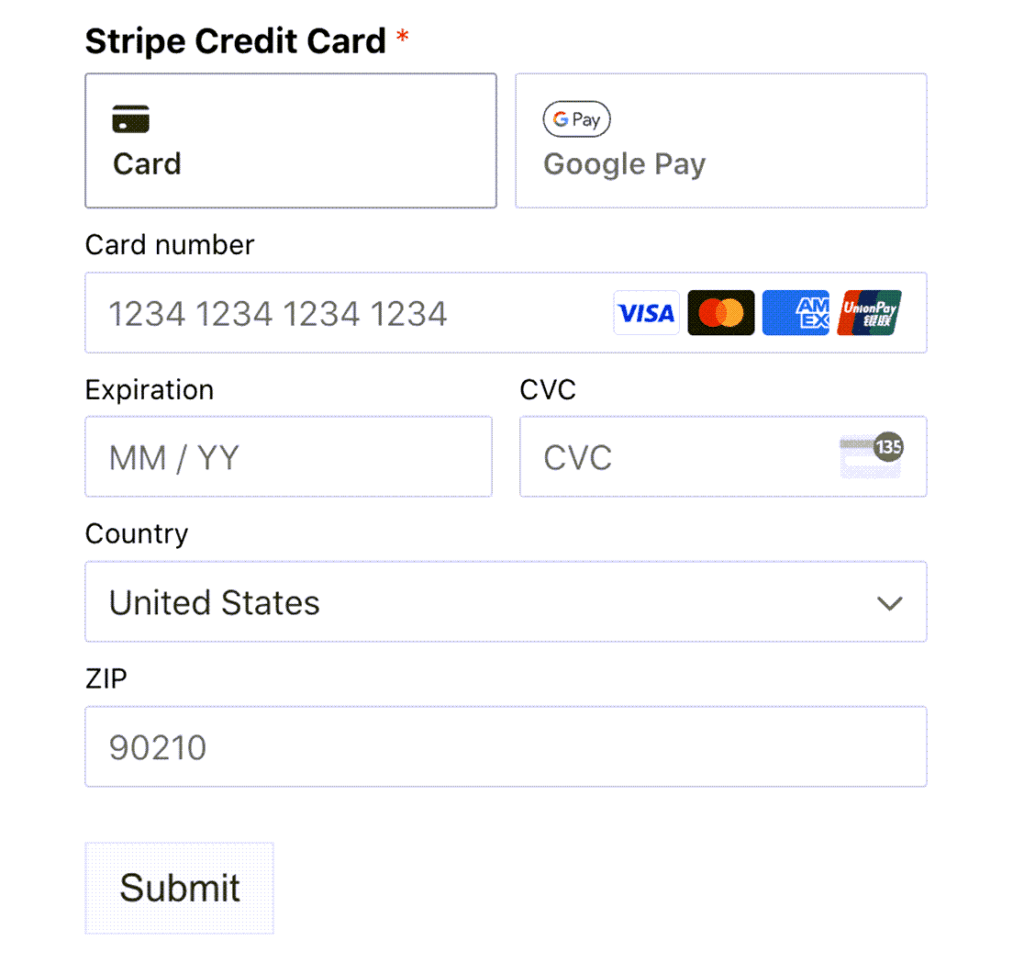

WPForms comes with a direct integration with Stripe that’s ready right out of the box. All you need to do is connect with your Stripe account using your login credentials and you’re good to go.

Stripe is also available for Lite users with a 3% processing fee along with the regular Stripe fees. A key feature is Stripe Webhooks, which syncs WPForms with Stripe.

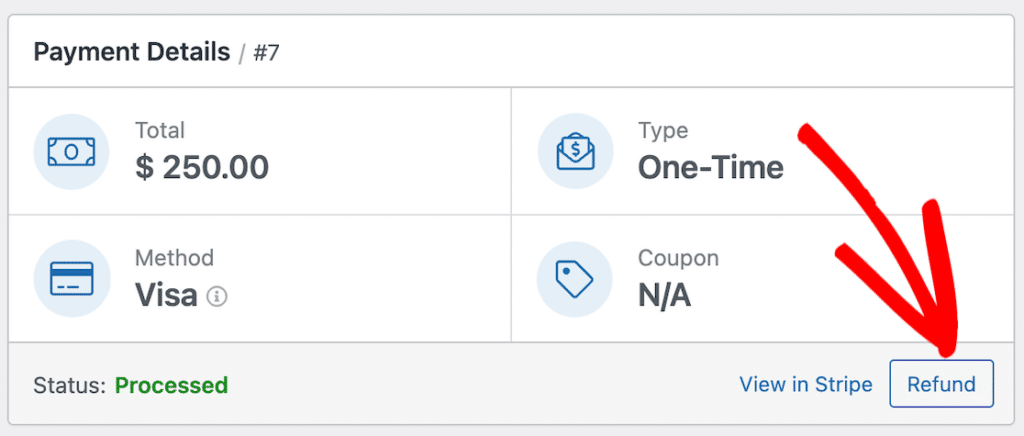

This way you can manage transactions directly on your WordPress dashboard without switching between platforms by processing refunds, cancelling subscriptions, and more.

All payment records, including real-time statuses, are accessible from the WPForms dashboard too. This is super convenient as it brings all your transactions to a single place, making it easier to track and manage your payments.

Customers using Apple Pay or Google Pay can also complete transactions effortlessly on supported devices and browsers when purchasing through your Stripe-enabled payment forms.

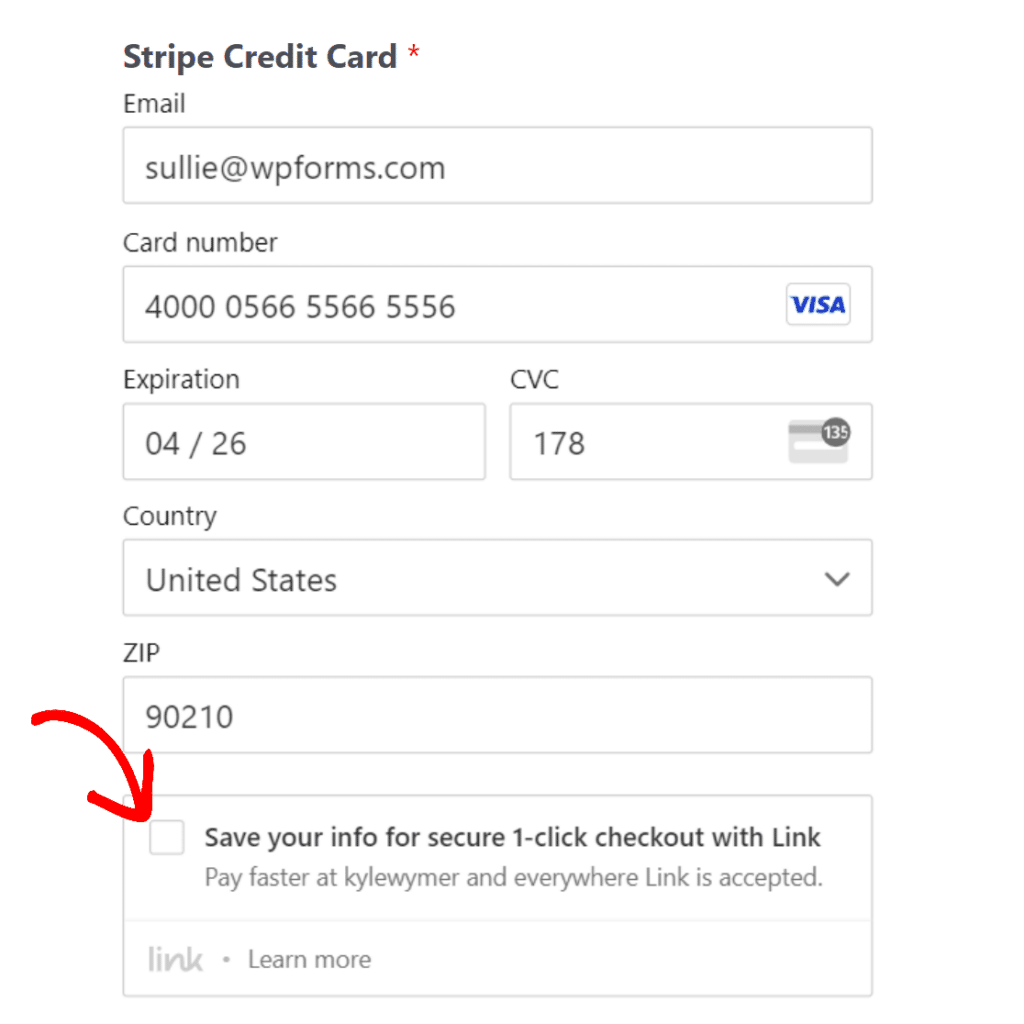

Another useful tool is Link by Stripe, which allows returning customers to check out faster by storing payment details for one-click purchases.

This is enabled by default in WPForms and is a great feature for enhancing the user experience by eliminating the need for repeated data entry.

As I mentioned earlier, there’s an additional 3% transaction fee on top of Stripe’s standard fees for WPForms Lite users. But upgrading to WPForms Pro removes this extra charge.

The Pro version also unlocks the Stripe Pro addon, which offers advanced payment features like conditional logic for Stripe transactions.

It’s great for adding flexible payment options between one-time and recurring payments, as well as offering different subscription plans on a single form.

PayPal

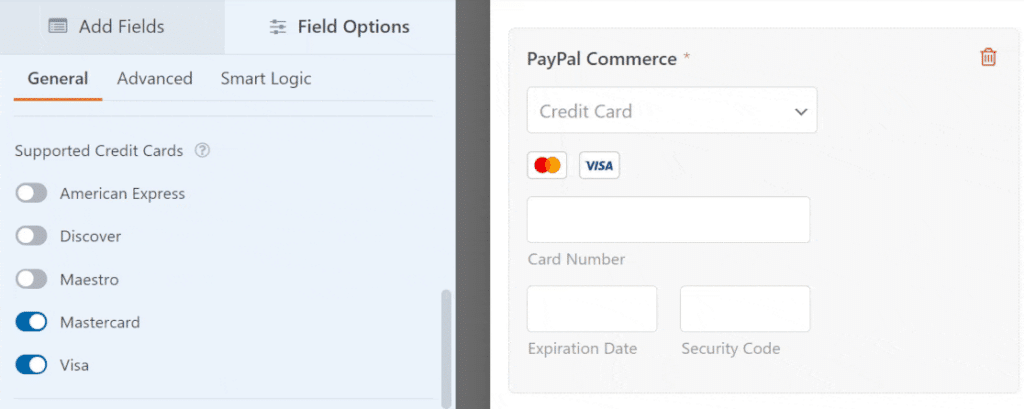

WPForms also works great with PayPal using the PayPal Commerce addon. The integration process is easy and only requires you to log into your PayPal account with your credentials to connect PayPal with WPForms.

With PayPal Commerce, you can also select which credit cards you want to accept and whether you’d like to enable PayPal checkout.

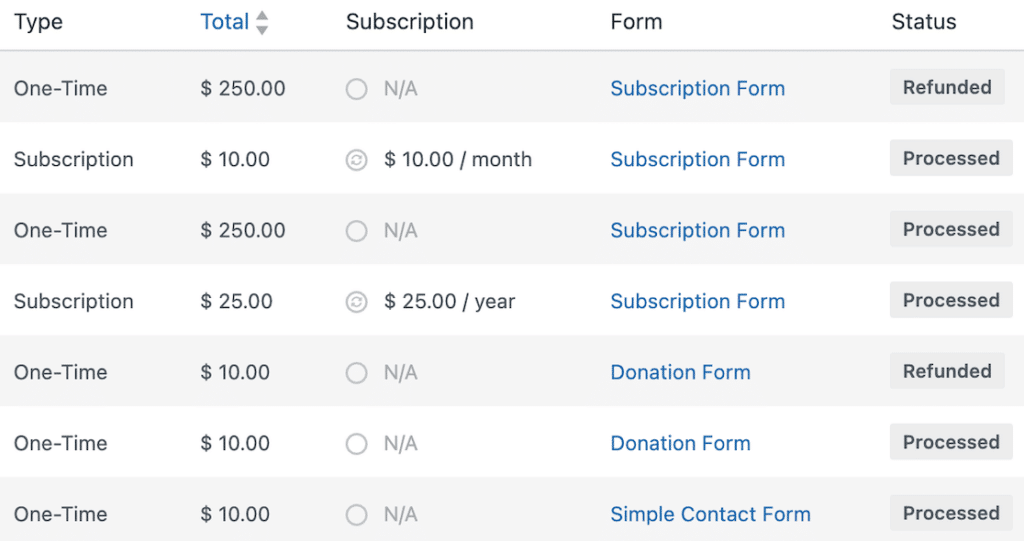

Regardless of the payment gateway you’re using in WPForms, you can still track every payment in a single screen. So if you have multiple payment gateways, you’ll find a detailed record of all transactions in your WPForms Payments area.

Unlike Stripe, PayPal is only available for WPForms Pro users.

How Long Do the Payouts Take in Stripe vs PayPal?

Stripe

Stripe’s payout speed typically ranges from 2-3 business days. In some countries, this can extend up to 7 days in some depending on banking facilities and region-specific considerations.

By default, Stripe provides daily payouts. However, businesses have the flexibility to adjust the payout schedule to weekly, monthly, or manual disbursements. Note that a daily payout schedule means the funds you receive on a given day may be associated with your earnings 2 to 3 days prior.

Stripe doesn’t change any fee for standard payouts. But you can opt for instant payouts at a cost of 1%. This typically takes a few minutes. and is an attractive option for those needing immediate access to funds.

PayPal

PayPal’s transfer process varies depending on where you’re receiving your funds.

For bank transfers, PayPal processes funds within 1-3 business days, although this can differ depending on the recipient’s country and bank processing timelines. Users can set up a schedule to move money from their PayPal balance to their bank account regularly.

For instant access to funds, PayPal offers an Instant Transfer service. This is similar to Stripe’s instant payouts but it costs slightly more with a fee of 1.75% per transfer.

Additionally, using a PayPal Debit MasterCard allows for immediate access to PayPal balances without the need for a bank transfer.

Support, Availability, and Ease of Use: Stripe vs PayPal

Both Stripe and PayPal are known for being super easy to use.

However, they require some technical expertise to set up on your website depending on your implementation. For instance, if you want to directly add a Stripe payment form, it will take some coding knowledge to add it to your site.

These complications quickly disappear if you use apps and plugins designed for your website’s native environment with an easy integration with Stripe.

So if you’re using WordPress, you can use WPForms to build payment forms that let you accept payments with either Stripe or PayPal. This way, you avoid having to manually create an integration between payment gateways and your website.

Stripe has several ways to get in touch when you have questions including a help center, social media, and chat support channels (with support reps or developers), plus phone and email support.

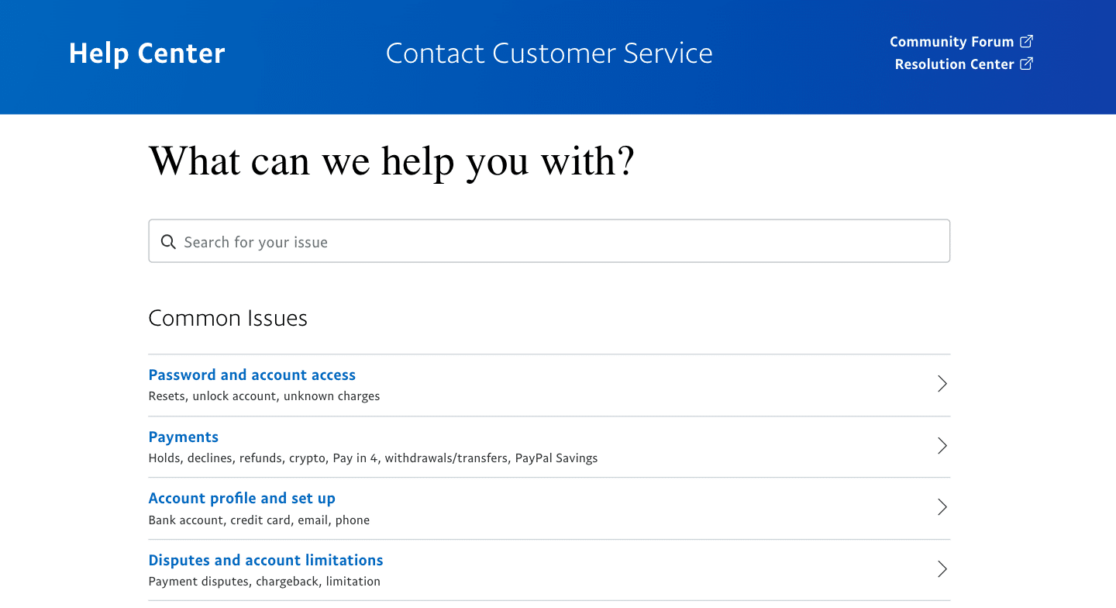

PayPal also provides multiple ways to get answers to your questions from their customer support team like a community forum, a help center, and social media, plus email, live chat and phone support.

Even with all these ways to get your questions answered, users still say that the quality of customer service from both Stripe and PayPal can vary from good to poor and is frustrating at times.

However, Stripe recently added 24/7 access to both phone and chat support while PayPal’s support still goes dark at some hours of the day.

To summarize:

- Ease of Setup: Stripe is more customizable over PayPal. However, to embed a feature like a “Pay With Card” button on your site, Stripe requires a bit more development knowledge and can sometimes be tricky for non-technical users. WPForms is the best Stripe plugin for WordPress, so integrating with Stripe and PayPal is a breeze. They’re both available in our pre-built form templates with the Stripe and PayPal Commerce addons.

- Availability: PayPal is available in many more countries than Stripe. Currently, PayPal is offered in 200+ countries while Stripe has just 46 countries (and growing).

- Online Invoicing: Stripe and PayPal both have customizable online invoicing. This is free with PayPal, but a paid service with Stripe.

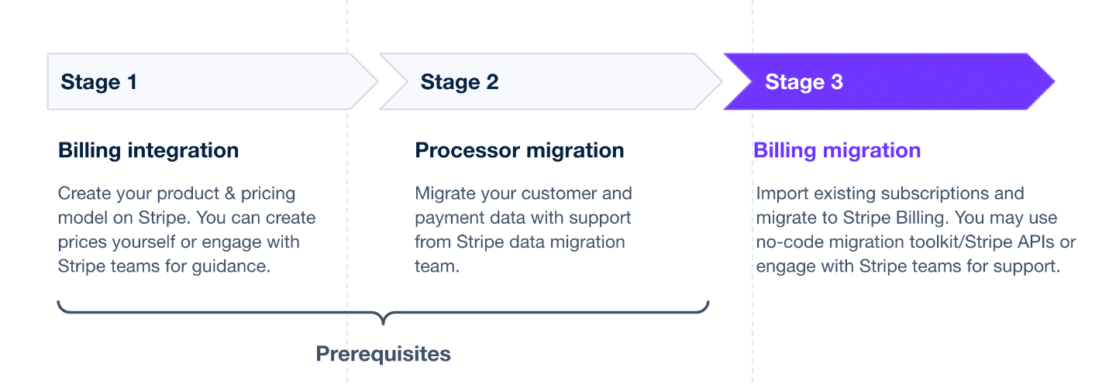

Which Payment Gateway Offers Better Security and Data Migration?

Stripe and PayPal offer a couple of different ways to provide you with peace of mind.

- Security: Both Stripe and PayPal’s services are PCI Complaint. In other words, they meet the strict standards of the Payment Card Industry and your cardholder data is stored securely.

- Data Migration: At some point, you may want to move all your data to another payment processor that is not Stripe or PayPal. Stripe and PayPal both provide free data migration service with another PCI compliant payment service.

When it comes to security for money, data, and private information, these features are incredibly important in a payment processor.

Does Stripe Hold Funds Like PayPal?

One major concern that I frequently see among people considering a payment solution for their business is whether the payment service tends to hold funds. Both Stripe and PayPal have specific criteria and scenarios where they might temporarily hold funds, but here are my thoughts about this issue:

Stripe

Stripe doesn’t typically hold funds as part of its standard operating procedure. However, I’ve seen this pattern whenever Stripe initiate holds:

- High-Risk Transactions: If a transaction seems suspicious or high-risk, Stripe might delay settlement until further investigation.

- Account Verification: New accounts or businesses experiencing rapidly scaling transaction volumes may face temporary reviews to verify legitimacy.

- Chargebacks and Disputes: If there are disputes or an elevated number of chargebacks, funds could be held until resolved.

Stripe tends to focus on evaluating the account activity as a whole rather than implementing systematic holds on individual transactions. In my experience, their emphasis is on maintaining a smooth cash flow unless potential issues are identified.

PayPal

PayPal is known for holding funds more frequently. I come across discussions online about PayPal holding funds much more than I do for Stripe. Here’s what I’ve seen so far:

- New Accounts: New sellers or accounts may experience holds as PayPal establishes transaction history and builds trust in the account. Similarly, infrequent sellers are more likely to face scrutiny and have their funds frozen.

- Dispute or Chargeback: When a dispute, claim, or chargeback occurs, funds related to the transaction are held until resolution.

- Unusual Account Activity: Accounts displaying patterns that deviate from typical usage might have funds placed on hold as PayPal ensures compliance and security.

PayPal generally has a more proactive stance on holding funds. The idea is to protect buyers and manage transaction risks, but it can end up being a huge pain when legitimate sellers are held up for simply being new.

Stripe vs PayPal – My Verdict

So which online payment gateway should you use?

The answer depends on your business’ individual needs including your industry, the type of customers you have, and what you’re selling. One type of merchant may prefer to go with one payment solution over another.

If you’re an eCommerce business and consistently processing credit card transactions, then the flexibility and support offered by Stripe might be for you. On the other hand, your business may require the online and in-person capabilities of PayPal, or you might prefer the more popular brand with its enhanced POS services.

It’s important to note that with WPForms, you don’t have to select just one payment solution to accept payments on your website. If you’d like to utilize both payment gateways, you can.

And there you have it! You can now make an educated decision about whether Stripe vs PayPal will be a better fit for your business to collect payments or donations online, based on their individual pros and cons.

Accept Stripe + PayPal on Your Forms Now

More Questions on Stripe and PayPal

Is Stripe or PayPal better for online payments?

Stripe is the better choice if you want lower fees on online payments, superior customizability, and wider range of useful third-party integrations. But PayPal is a more recognized brand, supports more countries, and has more robust POS hardware for brick-and-mortar stores.

Can I use Stripe and PayPal together?

Yes, you can use Stripe and PayPal on your site at the same time. Businesses often use both payment gateways to give their customers more options. WPForms allows you to add both Stripe and PayPal on a single payment form without any coding knowledge.

Is Stripe or PayPal better for recurring payments and subscriptions?

If you want to offer subscriptions or the ability to make recurring payments or donations, you probably want to go with Stripe. This functionality is where Stripe shines, as it offers tools like customer and payment reports. However, recurring payment also work pretty well in PayPal so you can’t go wrong with either.

Do Stripe and PayPal have invoicing?

Both payment options have invoicing, but Stripe is the better option. Its built-in features let you easily bill customers and track invoices. But if you want a free invoicing solution, you should choose PayPal.

How soon can I expect to receive funds?

With both Stripe and PayPal, you can typically expect to see funds arrive in 1-3 business days. Or, you can pay an additional fee for instant payouts.

Next, Collect Payments With Stripe

Now that you know all about collecting payments with Stripe and PayPal, it’s time to add a payment processor to your small business website.

Take a look at our helpful tutorial on how to accept payments with Stripe to get started!

Accept Stripe + PayPal on Your Forms Now

Ready to build your form? Get started today with the easiest WordPress form builder plugin. WPForms Pro includes lots of free templates and offers a 14-day money-back guarantee.

If this article helped you out, please follow us on Facebook and Twitter for more free WordPress tutorials and guides.